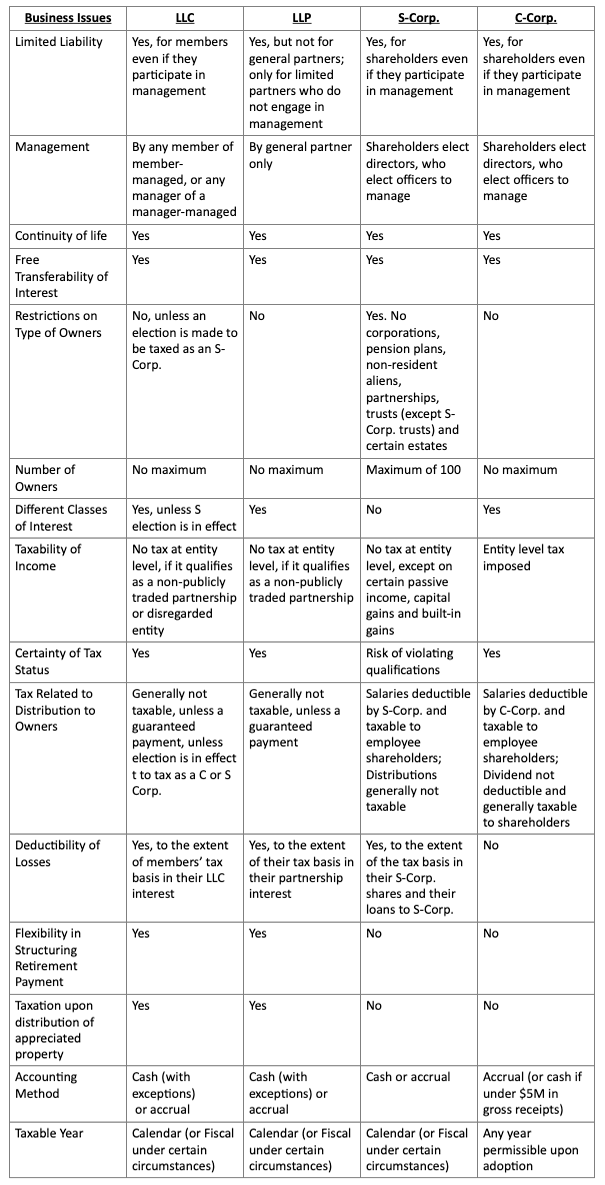

When you are ready to move from business concept to forming your business, you should have a thoughtful conversation with your Private Corporate Counsel about the forms of business entity amiable to you. While you can operate as a sole proprietor, a partnership of joint venture (if you are working with another person or business who is also investing in the business), when you are looking for special protection, tax considerations, and other benefits, it is prudent to learn about the following business entity forms before you decide which is best for you:

- Limited Liability Company (“LLC”);

- Limited Liability Partnership (“LLP”);

- C – Corporation (“C-Corp.”); and

- S – Corporation (SS-Corp.”).

While each of these forms of business entity have similarities, each also provide entrepreneurs with unique options, which, depending on your core business, may or may not be appropriate for your business. Here is a comparative analysis of some of the similarities and differences:

There are, of course, other considerations entrepreneurs should analyze with the help of their Private Corporate Counsel. If you would like more information on how to choose the best form of business entity for your business, please call us at 407-647-7887 or email us at info@pcc.law to talk to a business lawyer today.